Bear Spotting

The Quotedian - Vol VI, Issue 4 | Powered by Neue Privat Bank AG

"The most contrarian thing of all is not to oppose the crowd but to think for yourself."

— Peter Thiel

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

After missing last week’s Quotedian for ‘technical’ reasons, I am happy not only to announce that I am back to writing on a more regular basis again but also that I recently joined the fantastic team at Neue Privat Bank in Zürich! NPB is a pure private bank, where client attention and investment success are in the DNA. But check it out for yourself by clicking here.

Of course, it is also a very emotional moment for the family and me. In my case returning, not home (as we felt “home“ wherever we went over the past few years), but rather back to the roots 25 years later. And in the case of my wife and bunch of kids, all non-Swiss born, it is absolutely exciting moving yet to another country, and learning new cultures and languages.

Ok, enough of the tear shedding, let’s get the show rolling …

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

But just before we get started, I would like to highlight a bullet point I have added to our super-simplified disclaimer at the bottom of this letter:

The views expressed in this document may differ from the views published by Neue Private Bank AG

This is important, as my short-term focused, nearly daily blabbering has nothing to do with the sound investment process elaborated by the fine investment committee at NPB!

Ok, here we go…

We left off the last Quotedian (Checking In) two weeks ago, with a poll on what your preferred scheduling would be for The Quotedian going forward. Nearly 10% of the list members answered, with some of you making the effort to write me personally as the firewall prohibited you from direct polling. So, a big thanks to all pollsters:

Here is what we gonna do: The bare minimum will be a weekly long post on Sundays, with all the good intentions to have one to two updates during the week. Next week, for example, the monthly review edition will hit your inbox on Wednesday.

Ok, starting with equity markets, whatever happened to all the bears? Frustratingly hiding behind trees? Any spottings? As I had feared and written in “Ex-Ante” in early January:

Turns out I was right about being wrong 🤪

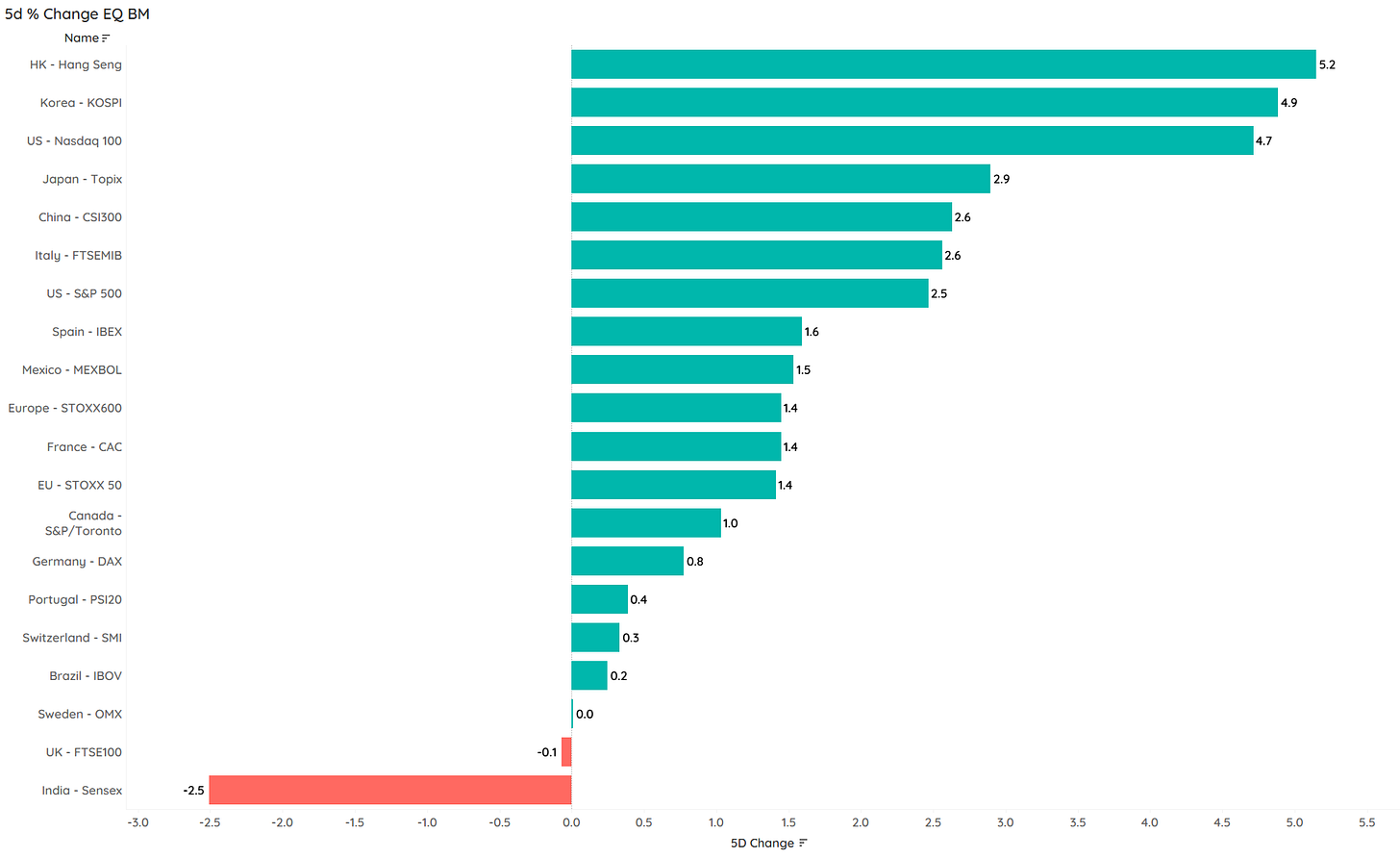

Here’s last week’s performance of major equity benchmarks around the globe:

A few things stand out:

For example, the reopening rally in Chinese/Hong Kong stocks continues. Here’s the Hang Seng index, up 55% from the lows and now having recovered nearly half of the entire drop since early 2021:

Or the Nasdaq has finally joined the rally and on Friday closes above its 200-day moving average for the first time since March 2022:

Further, whilst UK’s FTSE 100 index closed flat on the week, the index is less than two percent away from a new all-time high, a level it set two weeks ago!

And finally, the only losers for the week were Indian stocks, pressured bya damnifying report by famed short-sell Hindenburg Research on the Adani Group. Here’s an interesting read from Adam Tooze on the situation and here’s the chart of Sensex index:

Maybe finally a buying opportunity is in the offing? But don’t start bidding before 15,000 … minimum!

Let’s also take a quick look at the one index that rules them all … the S&P 500:

At last we have clearly cleared (🤔) the downward trendline in place since the top early last year AND the all-important 200-day moving average. NOT bearish! The final confirmation for the last doubters will be a close above 4,085, which will verify the pattern of higher highs and higher lows, aka an uptrend!

A hint that this will probably happen is in the offence (XLY - SPDR Consumer Discretionary) versus defence (XLP - SPDR Consumer Staples) chart, which is breaking out to new recovery highs:

Small-cap stocks (Russell 2000) are also looking increasingly interesting, with several things happening simultaneously on the chart:

Downtrend broken, and successfully retested as new support zone

200-day MA broken

Bounce from LT support zone

Golden cross (50d MA > 200d MA)

I remember a saying that goes went something like “so goes January, so goes the year”, which would be very comforting given the year-to-date gains for most indices:

Ryan Detrick at the Carson group recently posted some stats to actually confirm that theory:

So, what could possible go wrong?

Well, for one, CNN’s fear and greed index is getting close to the danger zone

and is at its highest level since the false rallies of last year:

Having said that, neither is the RSI on at technically overbought levels yet, nor are retail investors as measured by the American Association of Individual Investors Bull/Bear survey at extremes yet:

Ok then, just to finish off the equity section, here’s the sector performance for the past week:

As already noted further up, there’s a certain rush out of defensive value sectors in to more interest-rate sensitive growth sectors.

This of course serves as a perfect segue into the bond section of our observations, where we note that yields have stopped their decline, but also have not moved higher over the coming days. Here’s the 10-year US Treasury benchmark yield:

And here it’s European equivalent, proxied by the German 10-year Bund yield:

The latter looks slightly more “bullish”, which probably also will be reflected in the bond (price) performance of the week gone by:

Indeed have European bonds underperformed US bonds over the past five days. We also note that high-yield bonds have performed well, which would indicate that credit spreads have further narrowed:

Bingo!

Ok, I am running out of time (plane to Zurich is waiting) and space (1,200 words long already), so let’s push on by observing the next category - Currencies! Here’s the performance of global currencies versus the US Dollar over the past week:

The Aussie Dollar and Brazilian Real rally stand out to the upside, whilst the Indian Rupee is seeing (Adani Group related?) outflows. Another factor probably negatively impacting the Indian Rupee is the flight out of the neighbouring Pakistani Rupee, a country on the brink of bankruptcy and waiting for an IMF deal:

Quickly back to the greenback, with the chart of the US Dollar index clearly speaking in favour of a continuation of the risk-on rally in other asset classes:

A currency that is doing well and shows where money and business is flowing, is the Singapore Dollar:

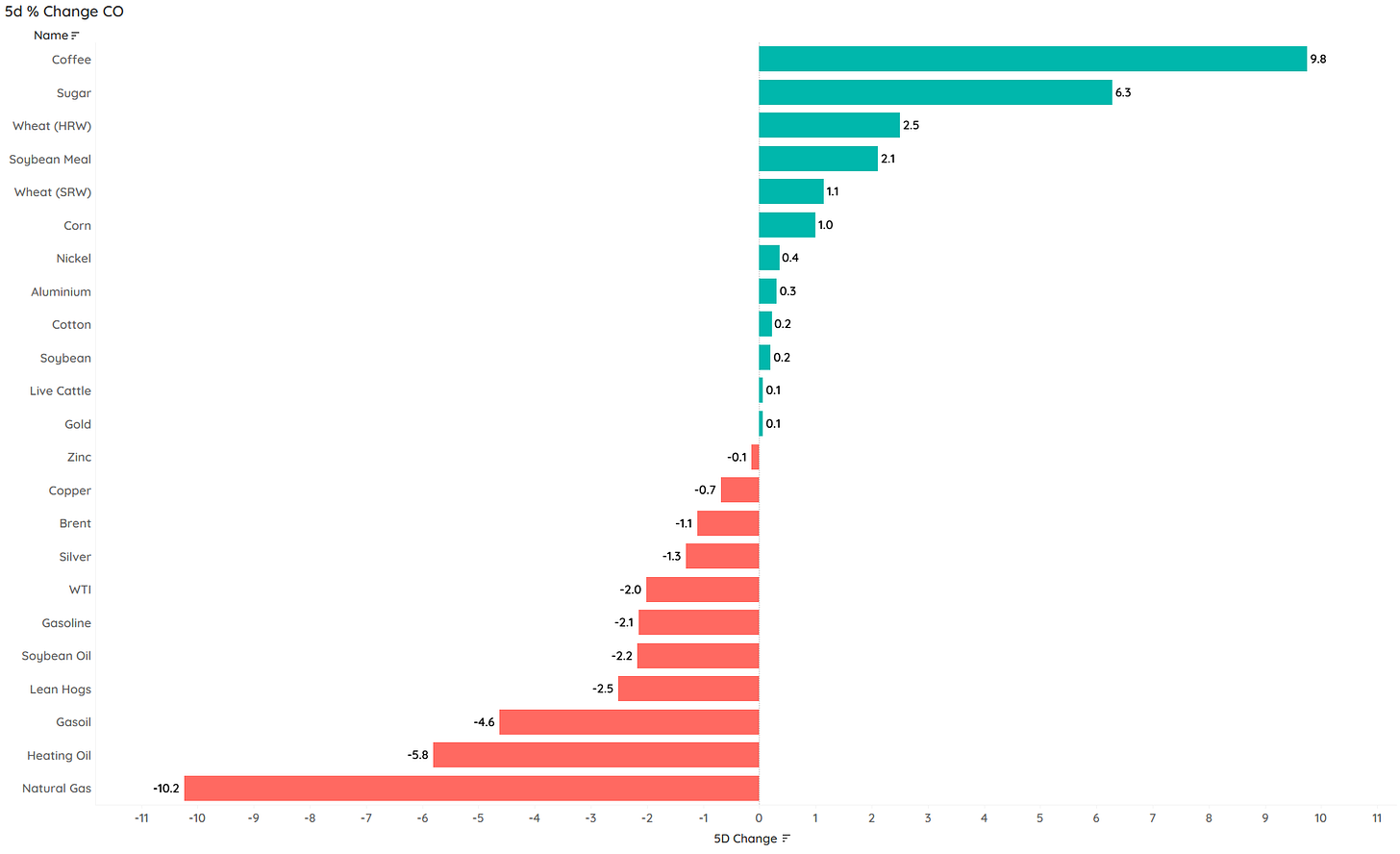

Finally, over the commodities, where a lot has been going on not only over the past year, but also in the past five days:

Wow, big moves!

Copper is suggesting that a recession is not so likely, but also that yields should probably be higher …

And the recent rally in lumber suggests that the worst for the housing market may lay behind us:

And finally, Gold has been a joy and would suggest that gold stocks (GDX) may have further to run:

Ok, enough for today. Happy to be back and looking forward to a more frequent communication rhythm again.

Got a comment? Leav it here:

Happy Sunday!

André

CHART OF THE DAY

With so many charts posted above already, many of them with COTD potential, I doubt you need another one on top of them. So here’s just a quick smile for you to finish today’s Quotedian off.

4,000 years later and we are back to the same language …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance