Ex-Ante (2026)

Vol IX, Issue 02 | Powered by NPB Neue Privat Bank AG

“Every age has its own outlook… We all, therefore, need the books that will correct the characteristic mistakes of our own period. And that means the old books.”

C. S. Lewis

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

As promised in Thursday’s Ex-Post 2025 review (click here), today’s Quotedian will take a look at what may lie ahead in the year that just commenced. However, I will try to keep it short, as a) I do not want to overwhelm you on your first day back in the office post the holiday break, and b) we are currently working non-stop on NPB’s “official” 2026 outlook, which is taking up a lot of resources.

Hence, in order to help me lighten this burden, I will a) rely heavily on charts and some technical analysis voodoo and b) ask YOU for your views on what will occur during the year.

Therefore, thank you very much in advance for your active participation, and please, please, let’s try to improve that response rate of only 5% of the readership of last year.

To keep matters simple and give access to all of you, we will not use difficult Bloomberg tickers, but rather broadly available and mostly popular ETFs.

Hence, without further ado, let’s start immediately with the overarching asset class question before we move into the different sub-segments. best-performing

Note that all the ETF’s used in the first poll above are denominated in USD.

As we observed in the previous Quotedian (ex-post 2025 - click here), equity returns were strong in 2025; however, currency hedging or the lack thereof had a significant impact.

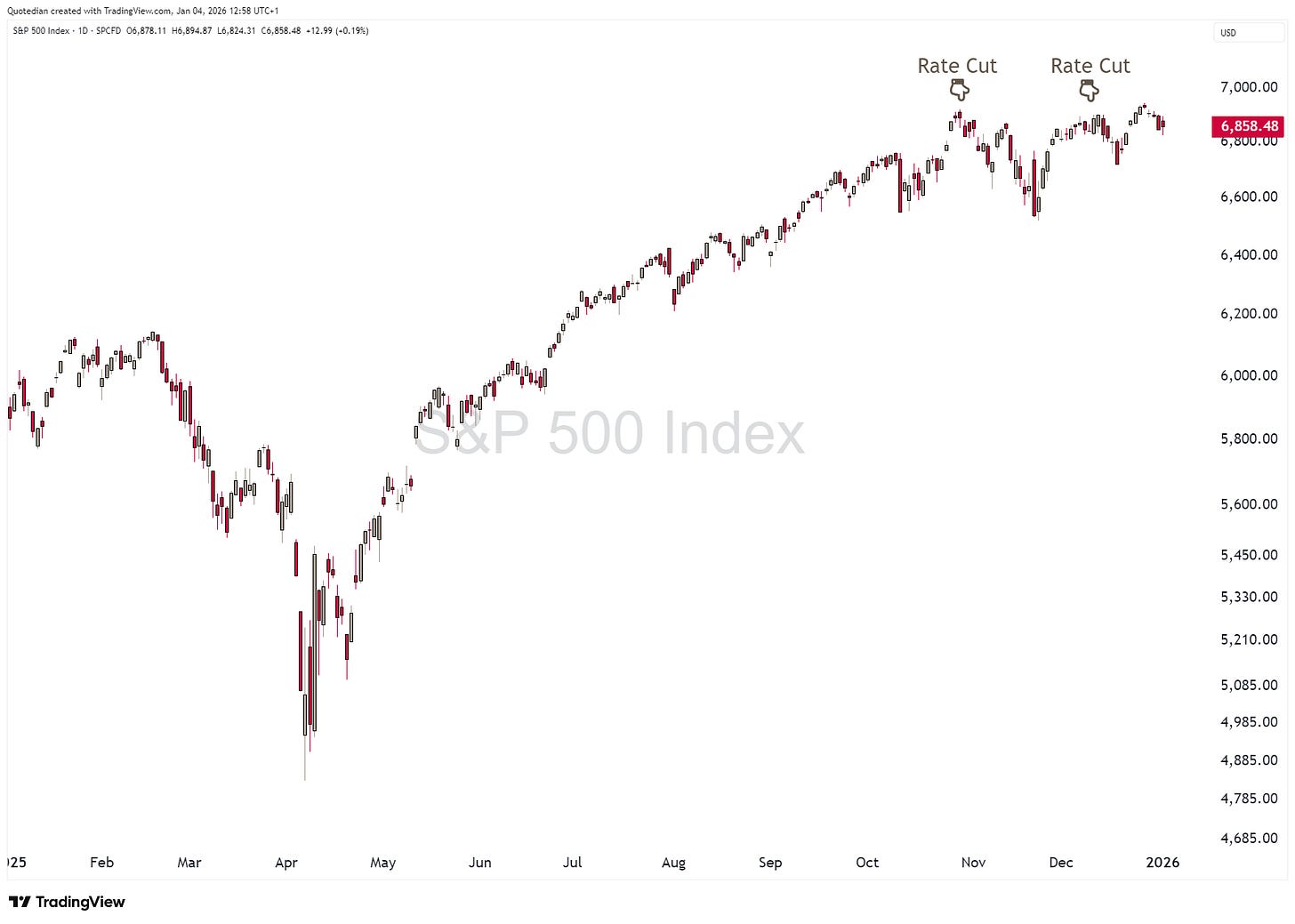

The S&P 500 ended the year up close to 18% in USD-terms. However, despite printing a new all-time high on Christmas Eve, the index has been struggling to make significant net progress since the US Federal Reserve Bank’s FOMC cut rates on October 29th:

Rather, the index feels a bit top-heavy here, at least from a visual point of view. And the tech stock-heavy Nasdaq 100 looks even, well, heavier:

Plus, the Santa Claus rally, a calendar effect that involves a rise in stock prices during the last 5 trading days in December and the first 2 trading days in the following January, has so far produced a negative one percent, with only one day (tomorrow, 5.1.) to go. And as we all know:

“If Santa Claus should fail to call, bears may come to Broad and Wall.”

— Yale Hirsch

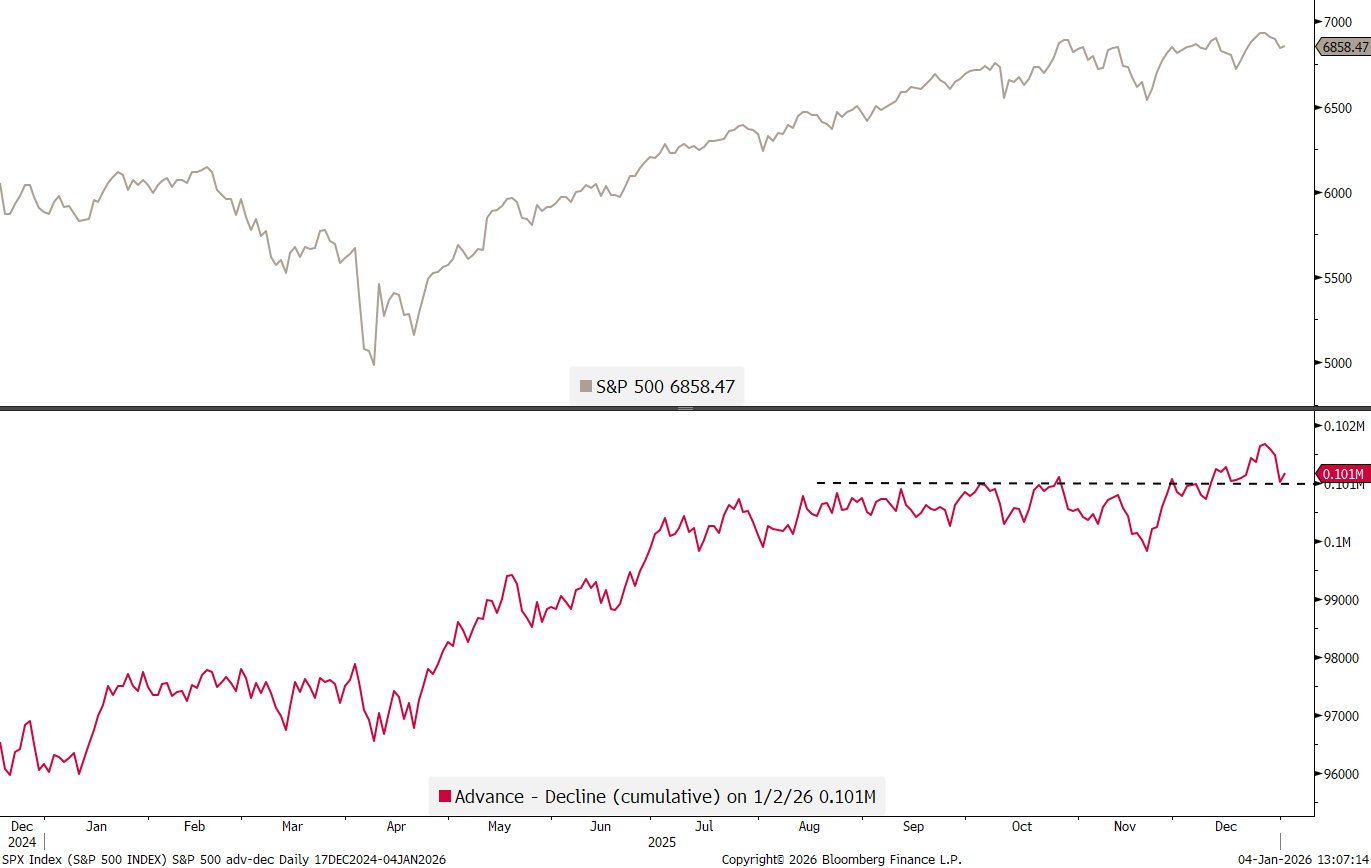

On a positive note, breadth, despite having waned somewhat in the final trading days of December, has not broken down yet:

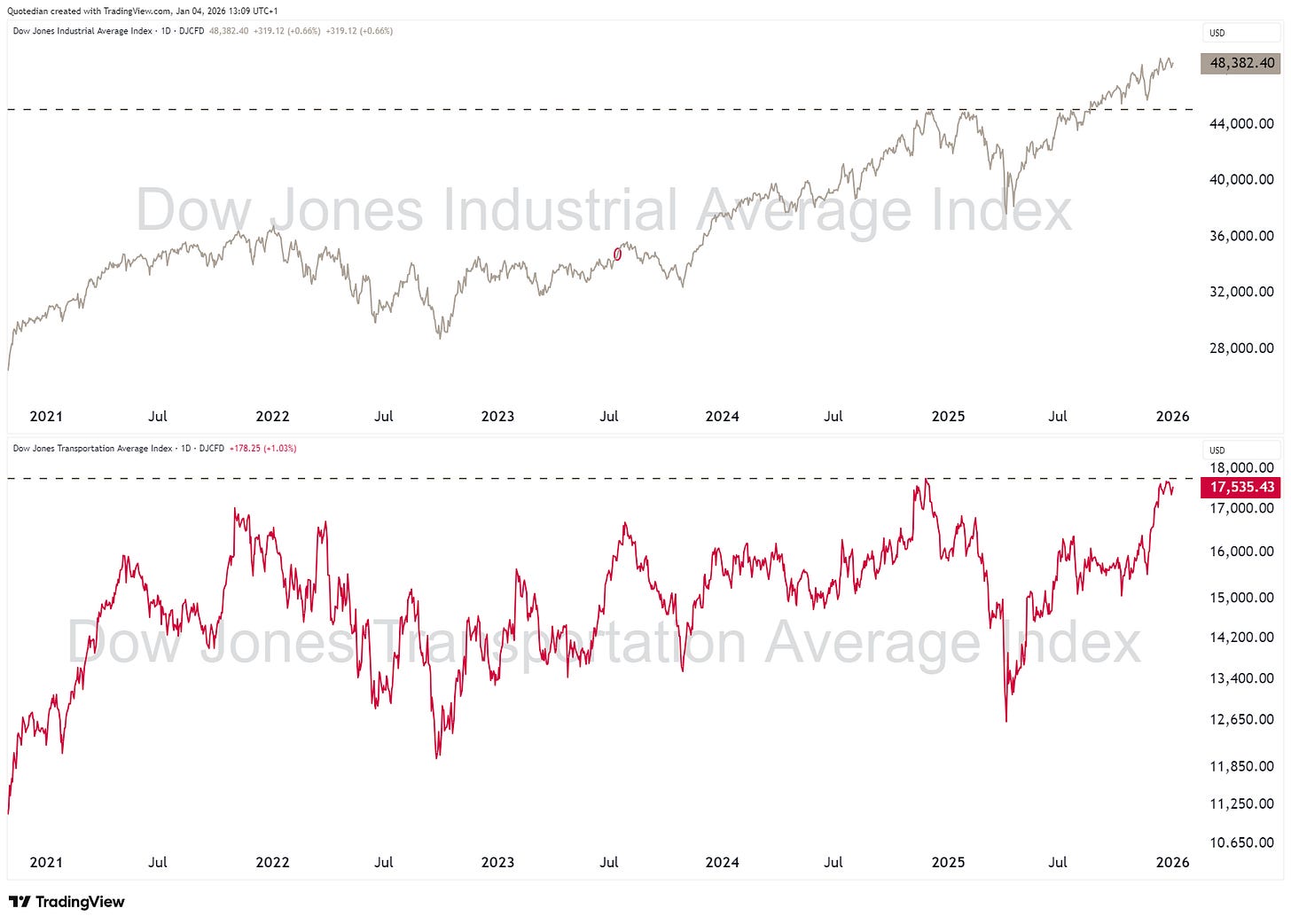

From a Dow Theory (click here) perspective, the DJ Transportation index (lower clip) has to move only a little higher to produce a massive buy confirmation signal:

European stocks, via the STOXX 600 Europe index, look much more constructive:

Even though the DAX remains range-stuck:

Switzerland’s SMI, long-lagging during 2025, was able to print a new all-time high on December 23 and continues to look constructive:

In Asia, Japan’s Nikkei may be ready to move out of its consolidation period to new all-time highs,

especially when considering the strength in the broader TOPIX (>1650 constituents) index:

Hong Kong’s Hang Seng Index has been range stuck during Q4, but could be ready for a move higher again:

Finally, India’s broad BSE500 index did not yet make a new ATH (dashed line), but at least a new cycle high (dotted line), suggesting that Indian stocks are back:

A new ATH seems to be on the books, especially when considering that the narrower NIFTY index has already achieved that feat last Friday:

Here’s are two equity questions then. First:

Note: All ETFs are USD-denominated.

And second:

Note: All indices above in local currency, except Indian stocks (USD)

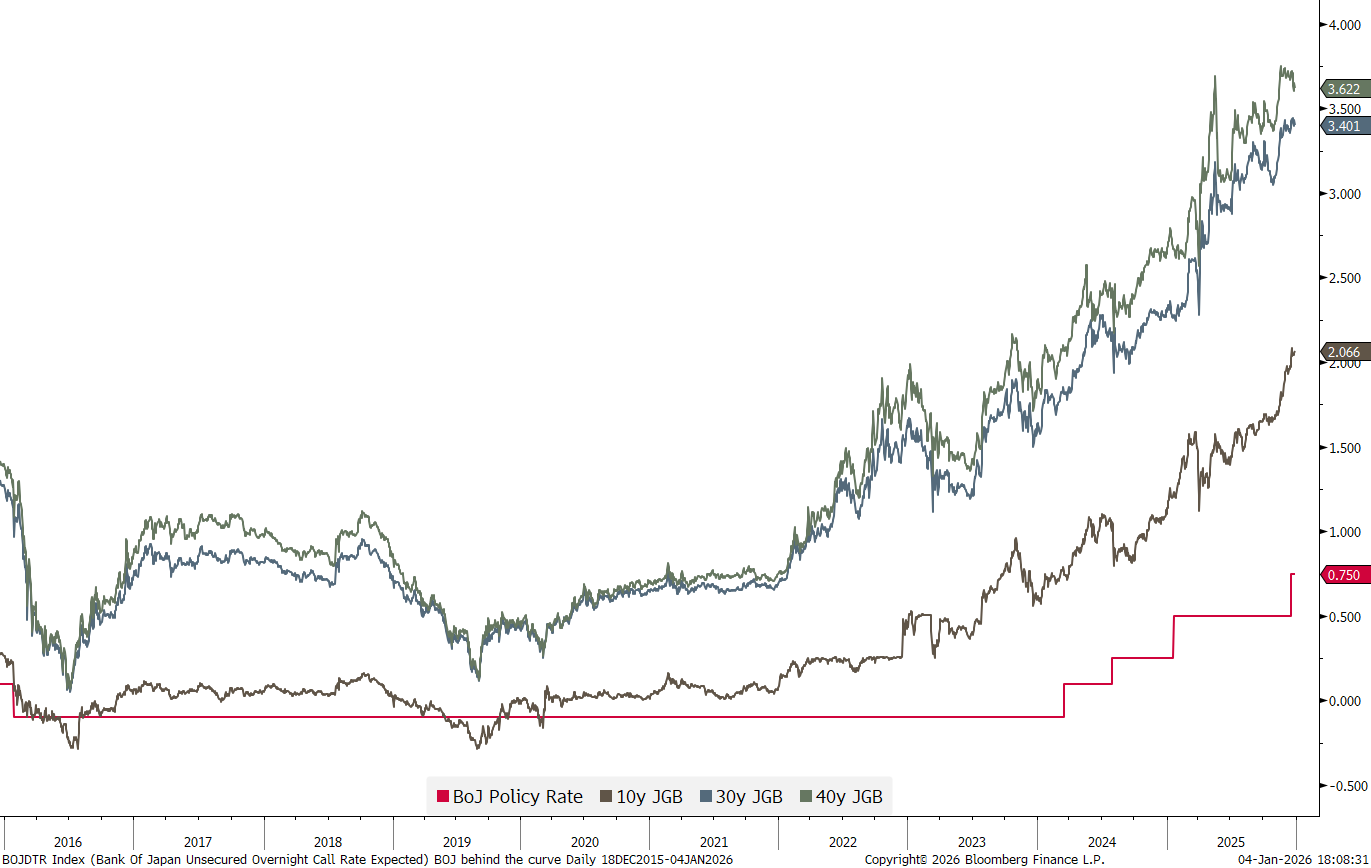

Fixed income markets where, from an US interest rate point of view and in comparison to the previous three to five years very range-bound - and a range that got narrower as the year progressed:

From a (very) long-term perspective, US bond yields have been in a consolidation pattern since late 2023, after the epic increase from close to 0% to 5% on the 10-year Treasury yield:

Technical analysis rules would have it that a resolution out of this consolidation triangle will happen starting Q2 of this year. Hence:

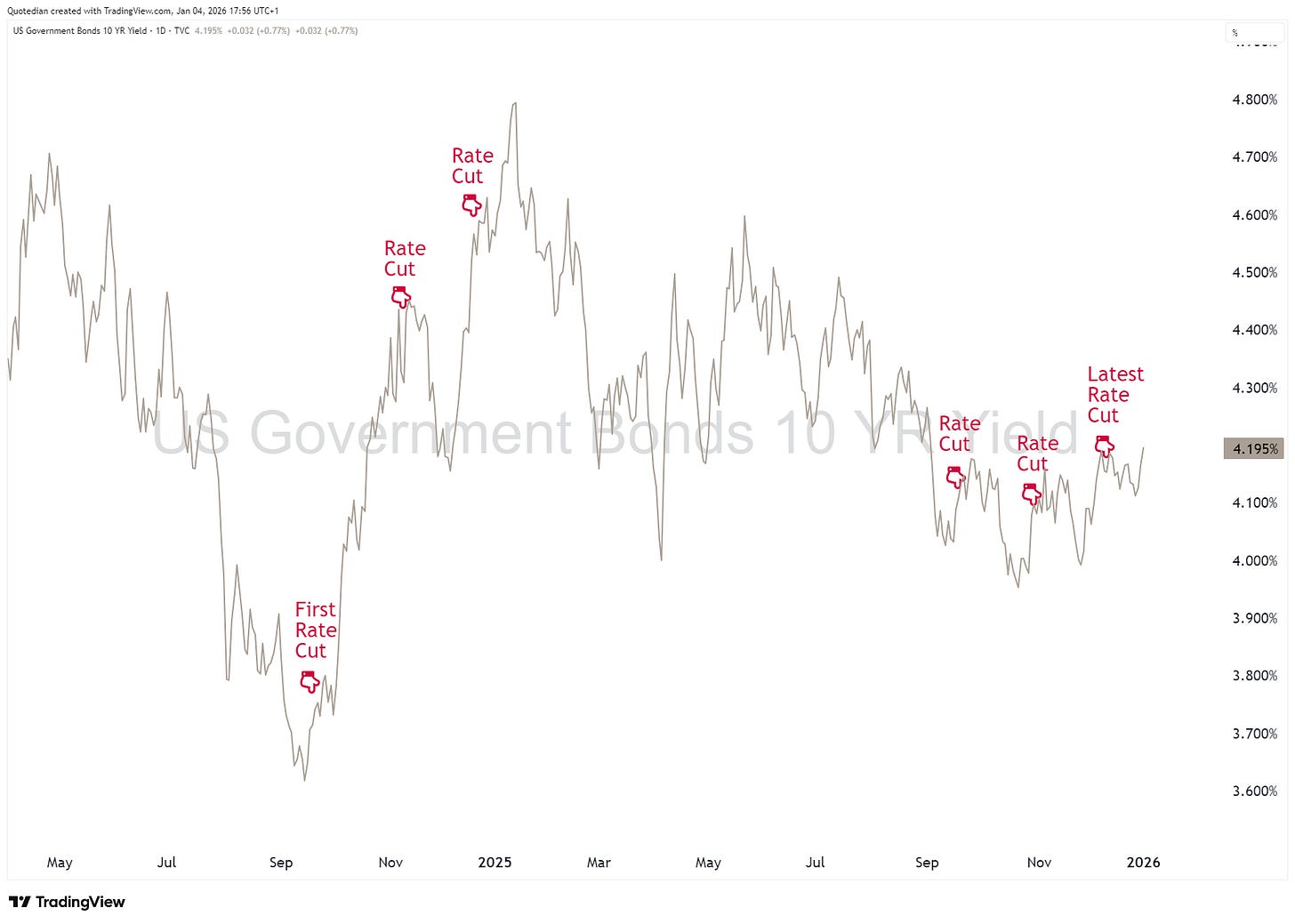

It is also noteworthy, that the US 10-year Treasury yield is now 50 basis points higher than when the Fed started its cutting cycle in September of 2024 and is also higher than after the latest two cuts:

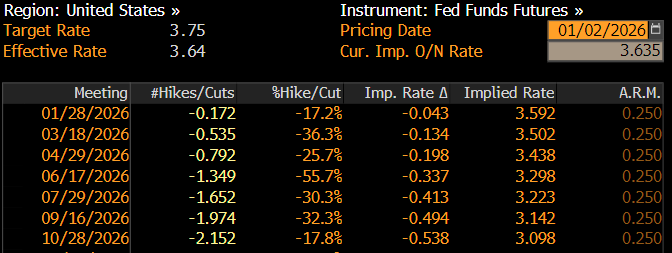

The current implied probability for further cuts is at two, which would take rates (upper boundary) to 3.25% from the current 3.75%:

German yields, as a proxy for European interest rates, have been stuck between 2.30 and 3% in 2025, but are currently pushing up against that three percent resistance line:

The market currently expects NO change in the key interest policy rate from the ECB:

What do you think?

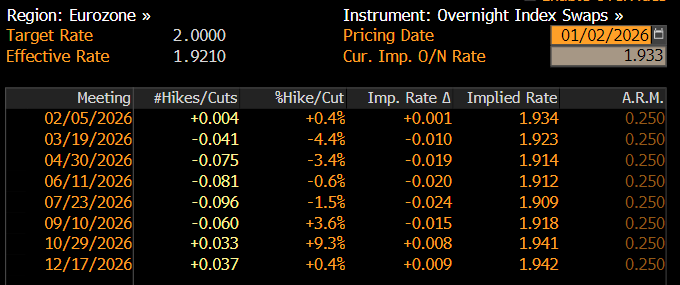

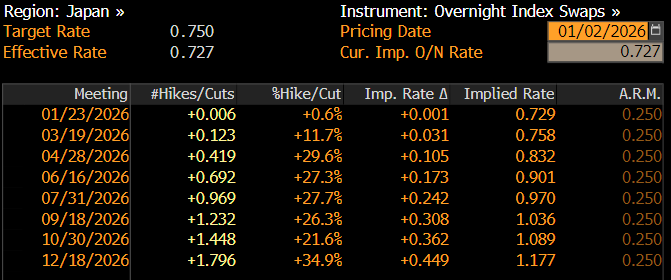

In Japan, the BoJ (Bank of Japan) has been slow to increase key policy rate, despite the long-end of the curve having exploded higher:

Maybe due to the BoJ’s stuborness to increase rates, the market is currently barely implying two hikes in 2026:

What do you think?

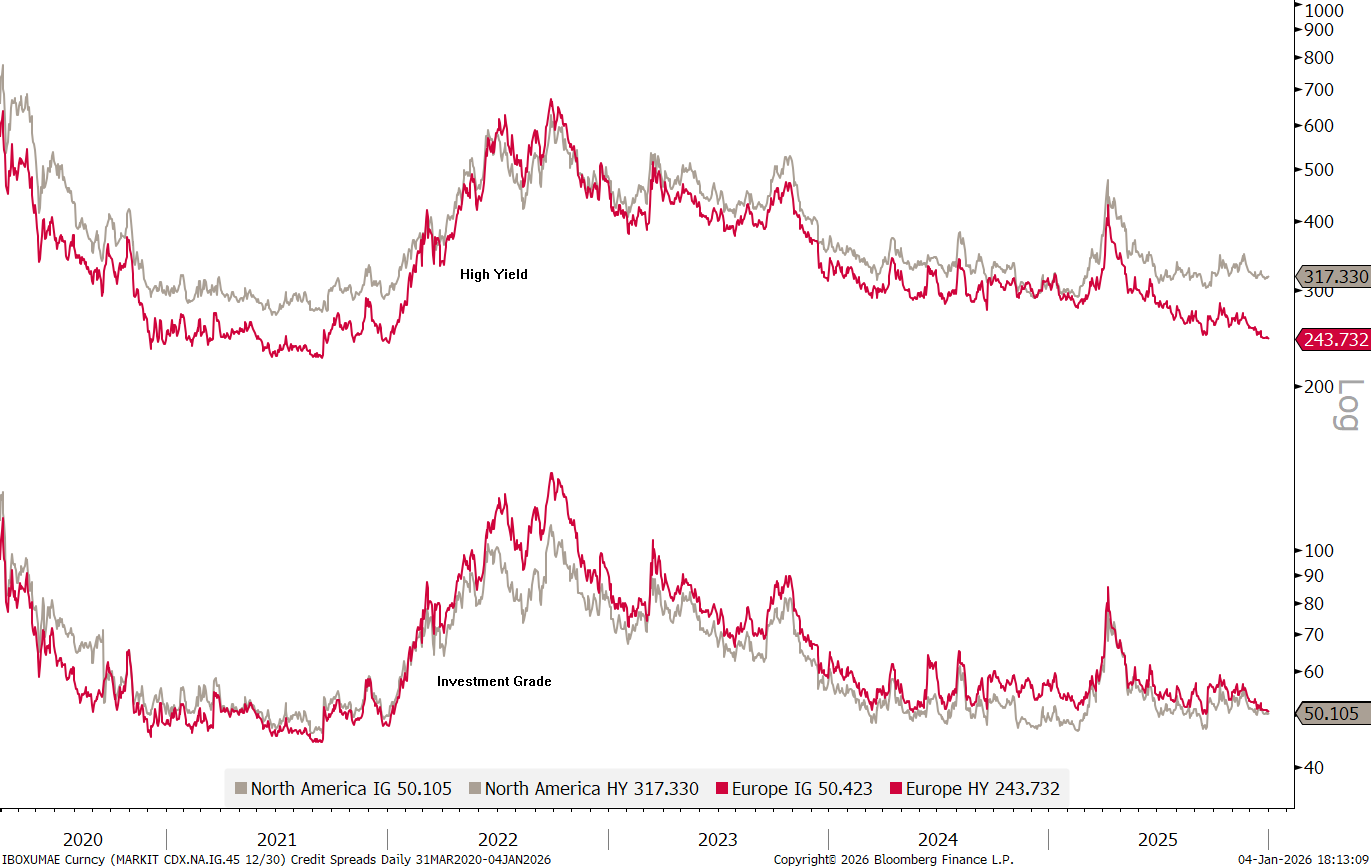

Finally, credit spreads are at one of their tightest levels on record:

I will not even bother to ask a question here 😂😂.

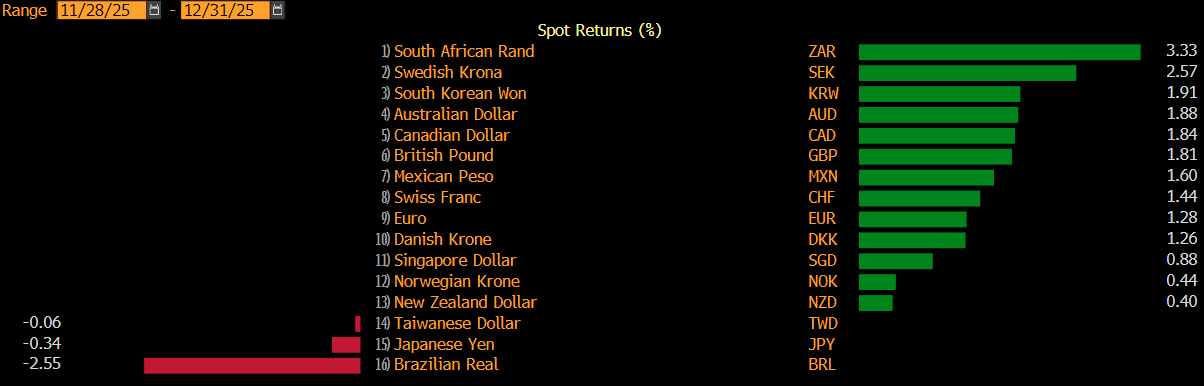

In global currency markets, the theme of 2025 was of course the weakness of the Dollar against (nearly) everything:

The Dollar Index (DXY) plunged nearly 10% into mid-year and then started trading sideways:

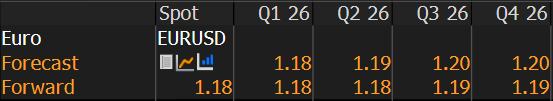

Translated on the EUR/USD chart, this meant that the cross moved from close to parity in early January to nearly 1.20 by September:

The consensus is now for the currency pair to move to at least 1.20 by year-end:

We have many times discussed how the consensus tends to be wrong, so in this case, what do you think?

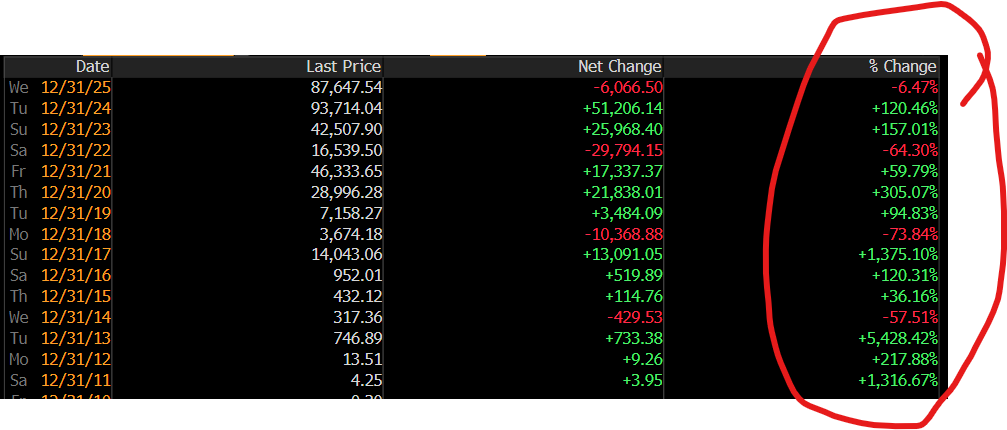

Bitcoin had its “flattest” year on record, with an annual change of -6% only:

Even intra-year volatility was RELATIVELY subdued for this cryptocurrency:

Is Bitcoin getting more mature as it is more broadly accepted and accessible (ETF’s, options, etc)?

Hence, to close the FX section:

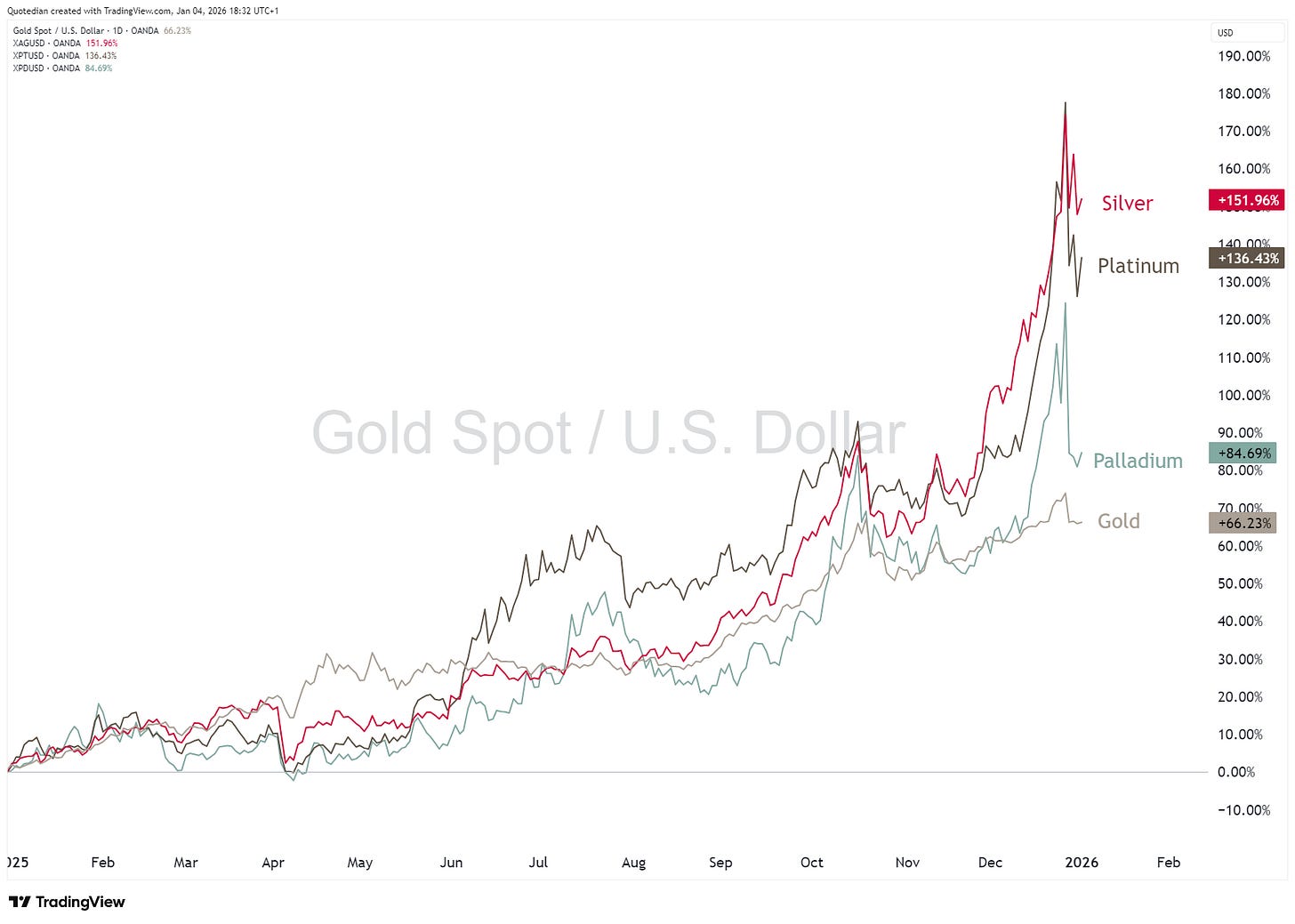

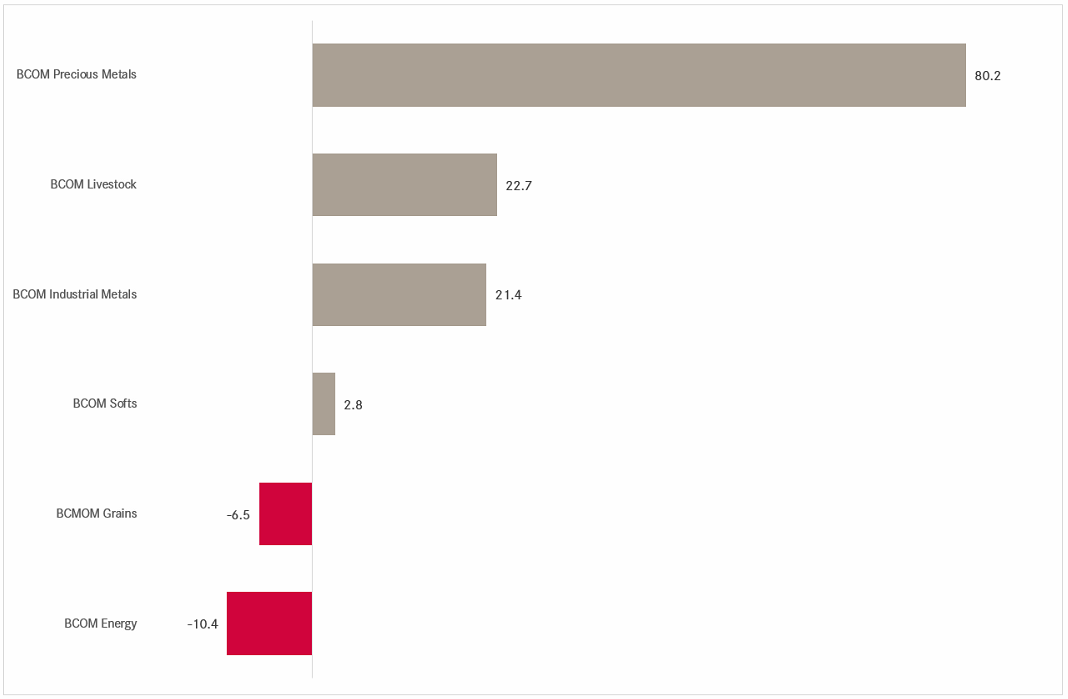

In commodities, clearly rally in precious metals was the main focus, with Gold being, maybe surprisingly so, the weakest performer:

The weakest link in commodities last year were energy-related commodities:

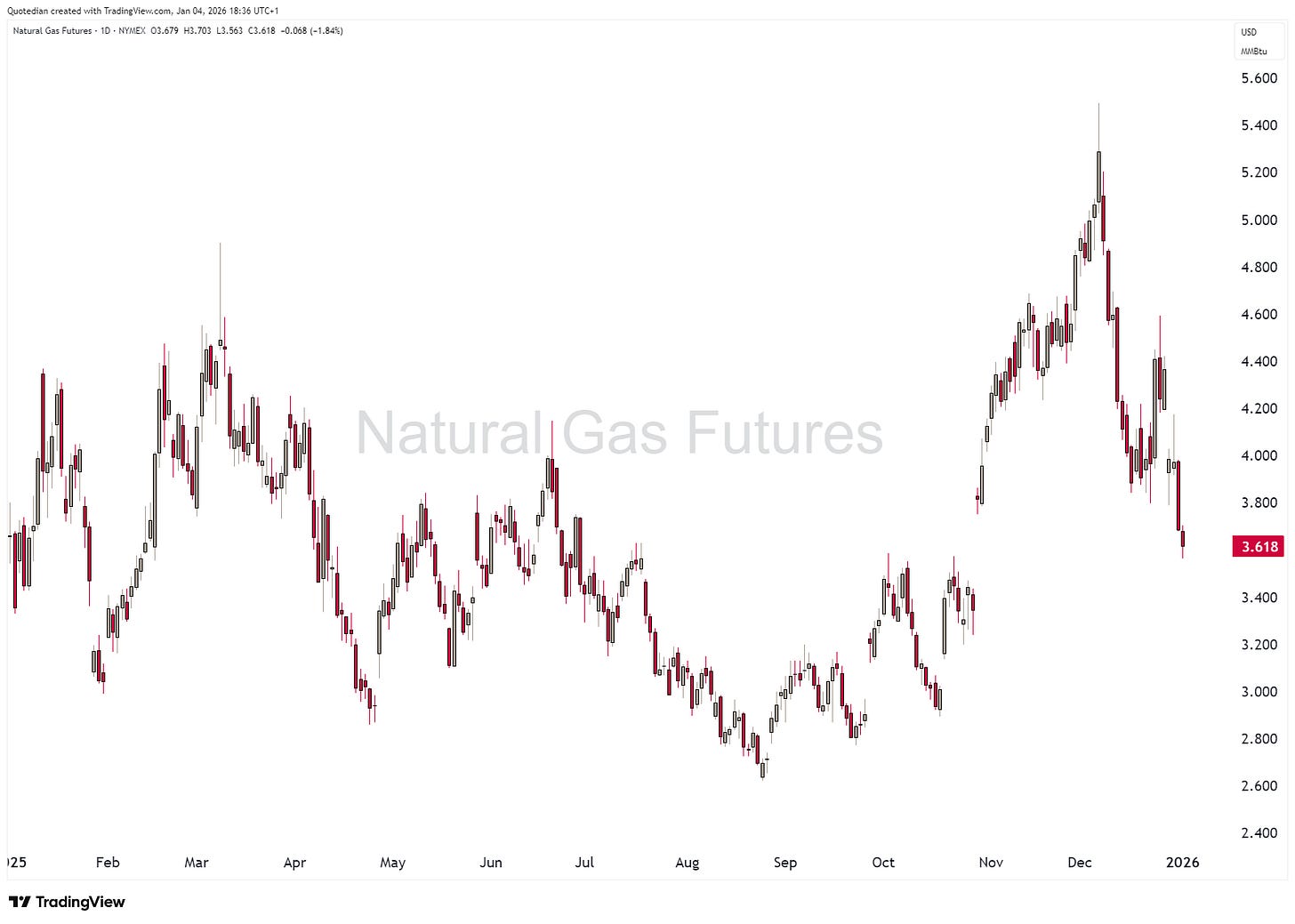

Whilst natural gas more or less held ground in 2025,

oil (Brent) was weak:

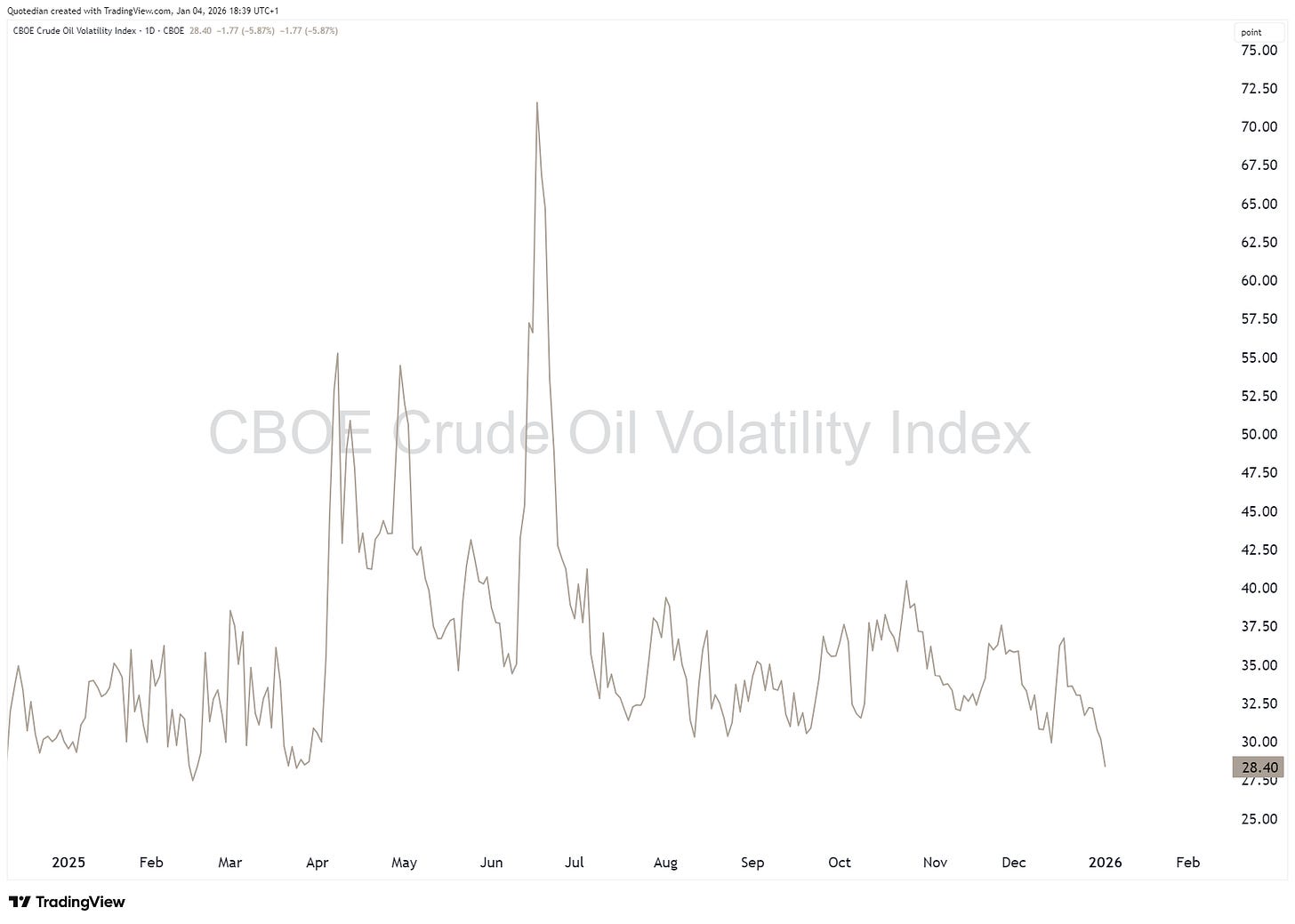

Oil volatility had decreased meaningfully during the year, however the very recent “invasion” of the US into Venezuela may bring that oil volatility index (OVX) back to life:

Hence, to our final question:

As I mentioned at the outset, I tried to keep this week’s Quotedian purposely short, with just a few main observations across asset classes. Tune back in next week, when we will review the main conclusions from NPB’s 2026 outlook and look at some of the more fascinating charts.

Have a great start into the year!

André

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by NPB Neue Privat Bank AG