Matter of Confidence

The Quotedian - Vol VI, Issue 58 | Powered by NPB Neue Privat Bank AG

"Get closer than ever to your customer. So close, in fact, that you tell them what they need well before they realize it themselves"

— Steve Jobs

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

In many ways Wednesday’s session was very similar to Tuesday’s: Rising bond yields, declining stocks with downside acceleration in the last hour of trading, a stronger Dollar …a few more sessions and we can call it a trend!

Hey, wait!

Scrolling back up to the dashboard we note that many equity indices already carry ‘sell’ signals for the short- and medium-term trends:

Bond yields, with the exception of Chinese government bonds, actually carry ‘buy’ signals (which translates into sell signals for prices) across all three-time horizons:

And the Greenback has at least a short-term ‘buy’ against all other major currencies:

With that, let’s have a closer look at yesterday’s session.

The good old Quotedian, now powered by NPB Neue Privat Bank AG

Different investment horizon request different investment approaches. Interested to find out more? Contact us at info@npb-bank.ch

Stocks on both sides of the pond held up relatively well, with stress on relatively, until Europeans left for their well-deserved “Feierabendbier”, after which US indices started to head lower, seeing an acceleration of the downtrend shortly before the closing bell:

Of course, did this headline not help, either on the equity or the bond side of things:

Breadth was not quite as monstrously bad as during the previous session, but still very bad with the advance-decline ratio reading 1:4.

Only one sector, utilities, managed to eke out an every-so-tiny gain, whilst the other ten sectors headed south:

Also, more stocks are currently hitting new 52-lows than reaching new 52-highs, which is a clear change from a few weeks ago:

This is not only the case in the US, but also in Europe:

With the 20- and 50-day moving averages AND the short-term uptrend channel now all ‘violated’, the bulls would need a very good day very soon to immediately negate those breaks again:

Otherwise, a visit to the 200-day MA (-6%) may be on the books…

As discussed yesterday, the Nasdaq has not quite broken down as much as the S&P from a technical perspective, with key supports from the trend channel and at 14,670 (dotted line) still intact, however, if especially the latter would give, there would be over 10% more downside to the 200-day MA:

And as we are talking key supports and 200-day MAs already, check out this chart of European stocks (SXXP):

Asian markets have no nice stories to tell this bright Thursday morning, with most regional indices down a half to a full percent and only a few nichier (not a word, but you know what I mean) markets flashing small green:

European index futures are suggesting that cash markets will open up about half a percentage point too at their opening.

Of course, it is less about stocks than about bonds at the moment, as renewed inflation fears and Fed rhetoric are pushing rates higher. The most conservative target for the US 10-year Treasury yield (aka Tens) is 4.50%, but we discussed here and here, that a more likely target is around 5%. Here’s the updated 1-year candle chart on the Tens:

And here is the longer-term chart of the same underlying, showing that we just hit the highest level since 2007:

The yield curve (10y-2y) continues is bear steepening process:

As I highlighted many times in the past, it is not the inversion of the yield curve that forebodes the recession, but the re-steepening from such inversion:

Credit spreads are (correctly) continuing their widening process, but as highlighted yesterday, the still seem to tight given what’s going on in bankruptcy terms:

In currency markets, the Dollar continues to strengthen, which can be interepretted as a certain flight to “safe haven”. Of course, there is this Damocles sword of an alternative reserve currency established by non-western countries and discussed next week, but this is a longer-term story (which we will discuss over the coming days).

Here’s an updated EUR/USD chart:

And here is the USD/JPY chart, with the Japanese Yen still unable to find a footing:

Bitcoin is drifting unconvincingly lower …

It’s high-time to hit the send-button, hence let’s skip the commodity section today.

With a relatively light economic agenda today, let’s see what curveball Mr Market will provide us in today’s session.

Take care,

André

CHART OF THE DAY

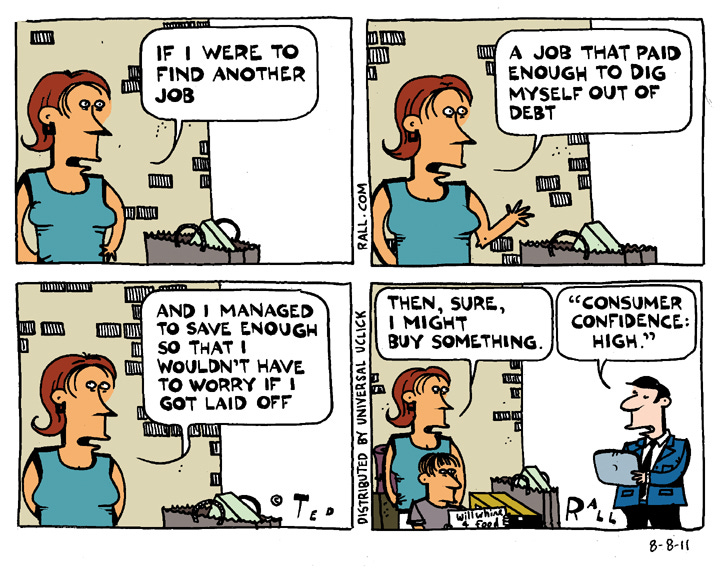

And now to solving the mystery surrounding today’s Quotedian title “Matter of Confidence” …

Two of the most important consumer sentiment survey in the US are the Conference Board Consumer Confidence and the University of Michigan Consumer Sentiment.

For some strange reason, they do not always give the same message regarding the state of the US consumer.

For example, here is the Conference Board version, which shows a steep pick up over the past months and pretty elevated levels, saying nearly everything is hunky dory for the US money spender:

The U of Michigan version also shows a recent improvement, but still trades well below the neutral (average) point:

Now, let’s create a spread between the two and overlay past US recessions:

It stands out to me, that every time this spreads peaks at a high level and then produces a divergence (arrows), it coincides with a recession.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance

Hi Antonio, thank you for your question. The clear answer is: it depends ;-)

It depends if you are referring to US or EU banks and what capital instrument, debt or equity? Overall I am probably a bit more constructive on EU banks, with a slight preference of debt over equity. But short-term I am bearish all possible combinations ... I will try and answer you question in more detail in an upcoming Quotedian

@ Andre, could you give your opinion you are more bullish or bearish on banking ?