“If you have nothing to say, say nothing”

— Mark Twain

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

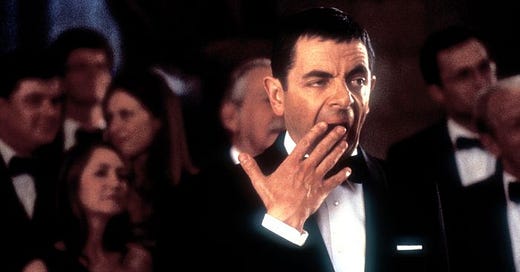

Today’s title of the Quotedian in one picture:

After two dull sessions, with equity indices on a road to nowhere and which I highlighted yesterday (see black circle on chart below), the market resolved its indecision to the upside, suddenly putting us back on track to reach our first objective at around 4,100 (~3%):

The session in itself, apart from the decent gains produced, was not very memorable. Or maybe we are just spoilt with massive macro- and micro-news on a daily basis in the recent past. In any case, breadth was strong with nearly 90% of the S&P 500 constituents moving higher on the day and all eleven sectors were higher:

The energy sector performance of over 3% higher on the day bugs me a bit, but I come back to that further down.

By the way, the VIX had been showing the path higher to the S&P 500, a situation I alluded to in yesterday’s Quotedian, and then had one of my D’oh! moments (maybe we should rename “The Quotedian” to “The Daily D’oh!”), by copying/pasting the wrong chart (thanks to my mate Marco for pointing it out). Here’s the chart that should have been there:

So, as today’s QOTD of the day says, if there’s nothing (little) to say, say nothing (little), hence I leave you with just one more observation in the equity segment before moving on.

With yesterday’s move, the S&P 500 and the Nasdaq 100 are 20% and 40% away from there now roughly year-old all-time highs. The Dow Jones is 8% away from reaching a new ATH. Say what?! Indeed, the Dow has done much better than its two other close cousins, which of course has a lot do to with age (read: duration). Interestingly enough, all three show the same pattern of an undercut of the June lows in October and then an ensuing bear market rally. More to come for the Spooze and the Qs?

(Bond) yield pressure waned yesterday, probably mostly due to the recent ‘dovish’ Fed talk in favour of slowing the hiking pace. Here’s the US 10-year yield chart, with a drop below 3.70% still likely on the books:

However, the (yield) weakness is mainly observed at the longer end of the curve, provoking further inversion of the curve. Here’s the 10-year yield minus the 2-year yield spread:

By the way, this is what the yield curve looks like today (green), compared to a year ago (brown):

Credit spreads continue in tightening mode, leaving yesterday’s questions about whether it is a) time to hedge again or b) time to take advantage of still higher spreads, very valid:

What’s your thought:

Little to say on the currency front, where the US Dollar has weakened a tad over the past two days, given back some of last week’s gains:

On the EUR/USD chart, should the cross close above 1.04, my scenario of consolidation back to parity would be largely nullified:

Ok, finishing off with commodities, let’s have a quick look at oil. I start with the admittance, that I lost the cools (i.e. exited the position) on one of my successful longs (VLO) this year, after oil had a big intraday drop on Monday:

Of course, VLO was subsequently up over four percent yesterday, turning me into a big, green, angry mass:

By all means, technically speaking, the momentum indicator (MACD) on a monthly chart, has given a sell signal:

But, the weaker oil argument is getting crowded. Be it the delayed China reopening, the looming global recession, the lack of impact on supply by the Russia-Ukraine war or whatever, all good heard arguments by now.

The lesser discussed wild card here could be the MENA region, where things are (as usual) just below boiling point, but civil unrest in Iran, might, and just might, be a tipping point. Let’s stay tuned …

Ok, enough for today. A bunch of US data out this afternoon as market is closed tomorrow, crowned by the release of the FOMC minutes towards the end of the session.

Probably C U tomorrow!

André

CHART OF THE DAY

So, today’s COTD is then a simple attempt to give the chart on oil in the commodity section above a slightly more positive spin. Looking at WTI, there seems to be a clear pivotal point at around $76. Hence unless we clearly close below that, we will stay neutral with an eye on possibly higher prices over the coming months. Below, all (oil) risk is off. Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance