Happy Old Year! (ex-post)

Vol VIII, Issue 1 | Powered by NPB Neue Privat Bank AG

"Life can only be understood backwards; but it must be lived forwards."

— Søren Kierkegaard

Happy New Year, dear Readership!

As today’s title will give away, the first issue of The Quotedian in front of you this year will be dedicated at looking back at the year just gone by. But not only will we check how different asset- and sub-asset classes have done during 2024, but put YOUR prediction capability to test. Yes, that! You may not remember, but a bit over a year ago, on December 13th 2023 to be precise, I asked you (see: Superforcasters) via a ton of polls what your market expectations were for 2024. In the following issue (see: Outrageous) we shared those results with you. Well, the moment of truth has arrived with this issue in front of you today.

Ok, ‘nuff said. Let’s get started with the 2024 outlook, starting with a glance on how the major asset classes have fared (all in USD terms). But just a note on a technical detail first: As I had to download the data shortly after midnight on the 1st January, YTD returns from my financial data provider was already set back to zero. Hence, all returns to follow are one-year returns, unless stated otherwise. Same difference as YTD returns really, but there may be a few basis points deviations from data you may read on other platforms.

Here we go:

Hmm, not a bad year for the plain vanilla 60/40 portfolio, but basically saved by the equity part, as bonds have likely been negative contributors, at least from the duration angel point of view.

By the way, here we had asked you in form of a Bonus Poll at the end of the letter last year, which asset class you expected to perform best in 2024:

Well done, you got equities right!!

Let’s explore each asset class in further detail, to see what sub-asset classes have been adding to the overall positive year and which have been negatively contributing. And yes, how your forecasting has done!

Let’s start the equity section with the first poll from December 2023:

This is how you voted:

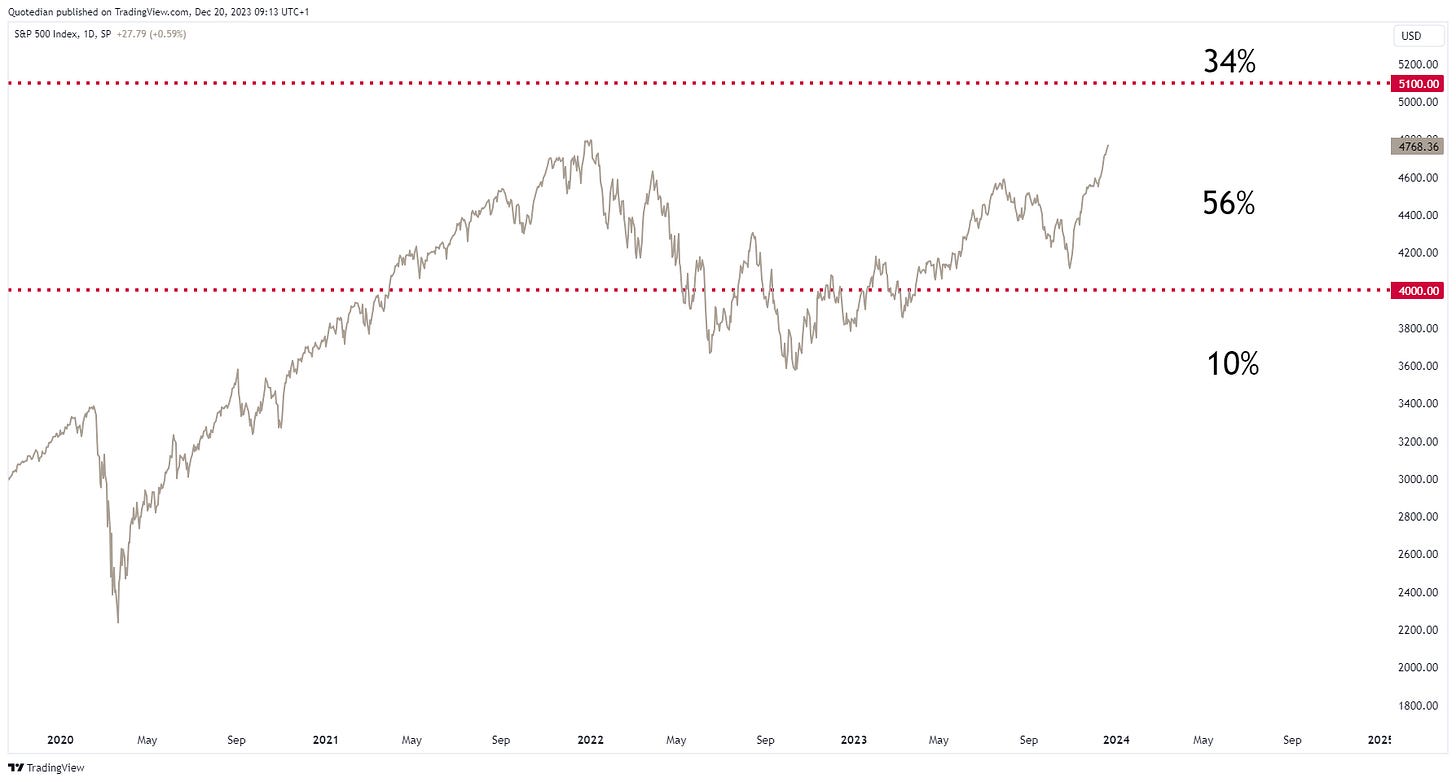

This is the outcome:

Whilst one third of you voted that the S&P 500 will close above 5,100, probably few expected the index to close nearly a thousand index-points above that level…

Now, checking in on all major benchmark indices, we note that 2024 was mostly a very good year of equity returns:

But, with at least two BUTS!

BUT #1 is of course geographical distribution of returns. Being US focused clearly paid off, as did being invested in German Large Cap stocks. But moving to the neighbouring country France, we see a pretty different outcome.

BUT #2 is in the following table. It reveals that even if you invested in the US, you had to make sure IN WHAT you were invested, as the returns of equal-weight indices was mediocre in comparison to the market cap weight versions. Here’s the same table as above, but adding equal-weight indices:

Of course, this means nothing else than, especially in the US, mega-cap stocks outperformed the wider market. Here’s one view to look at that:

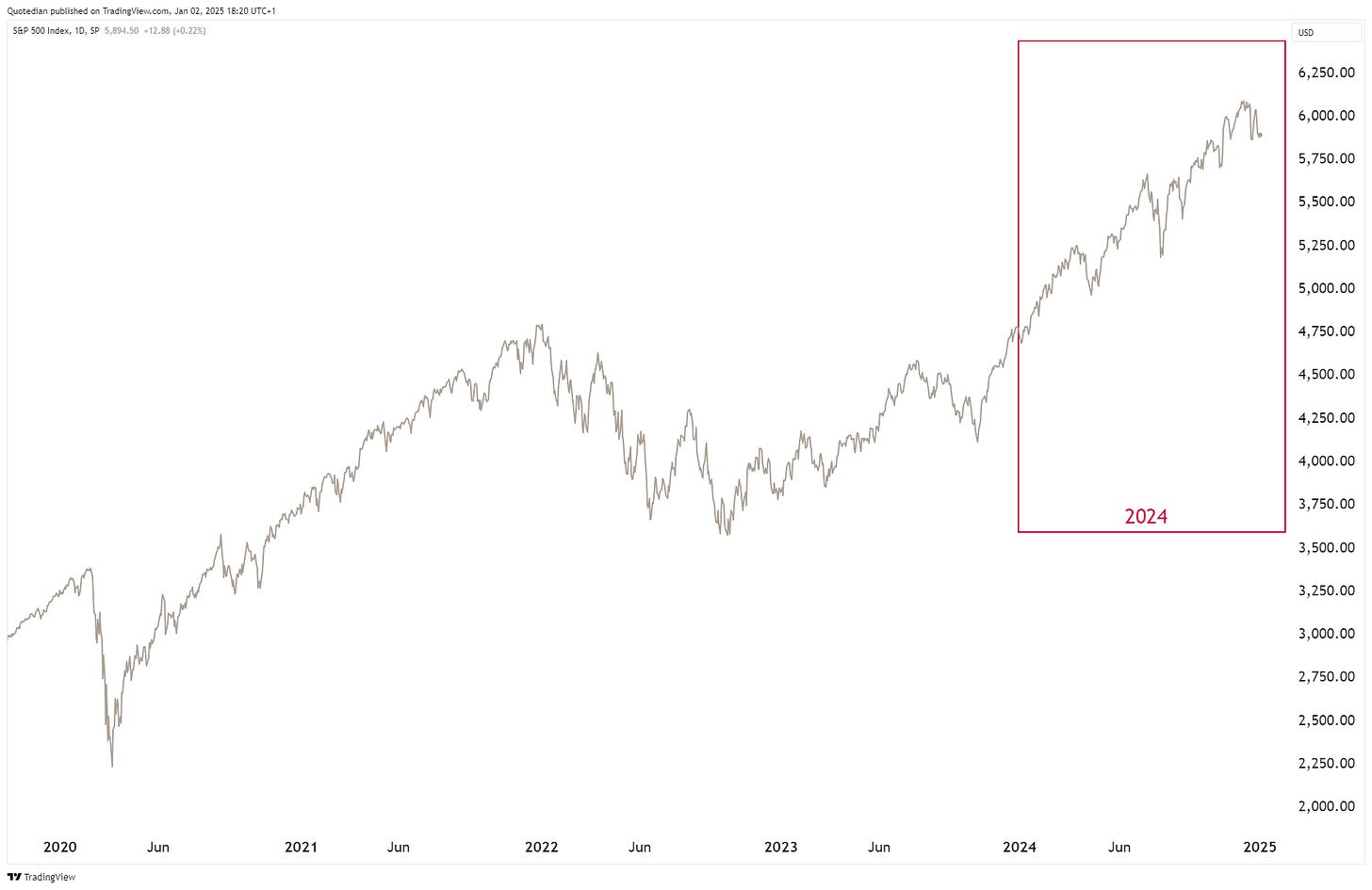

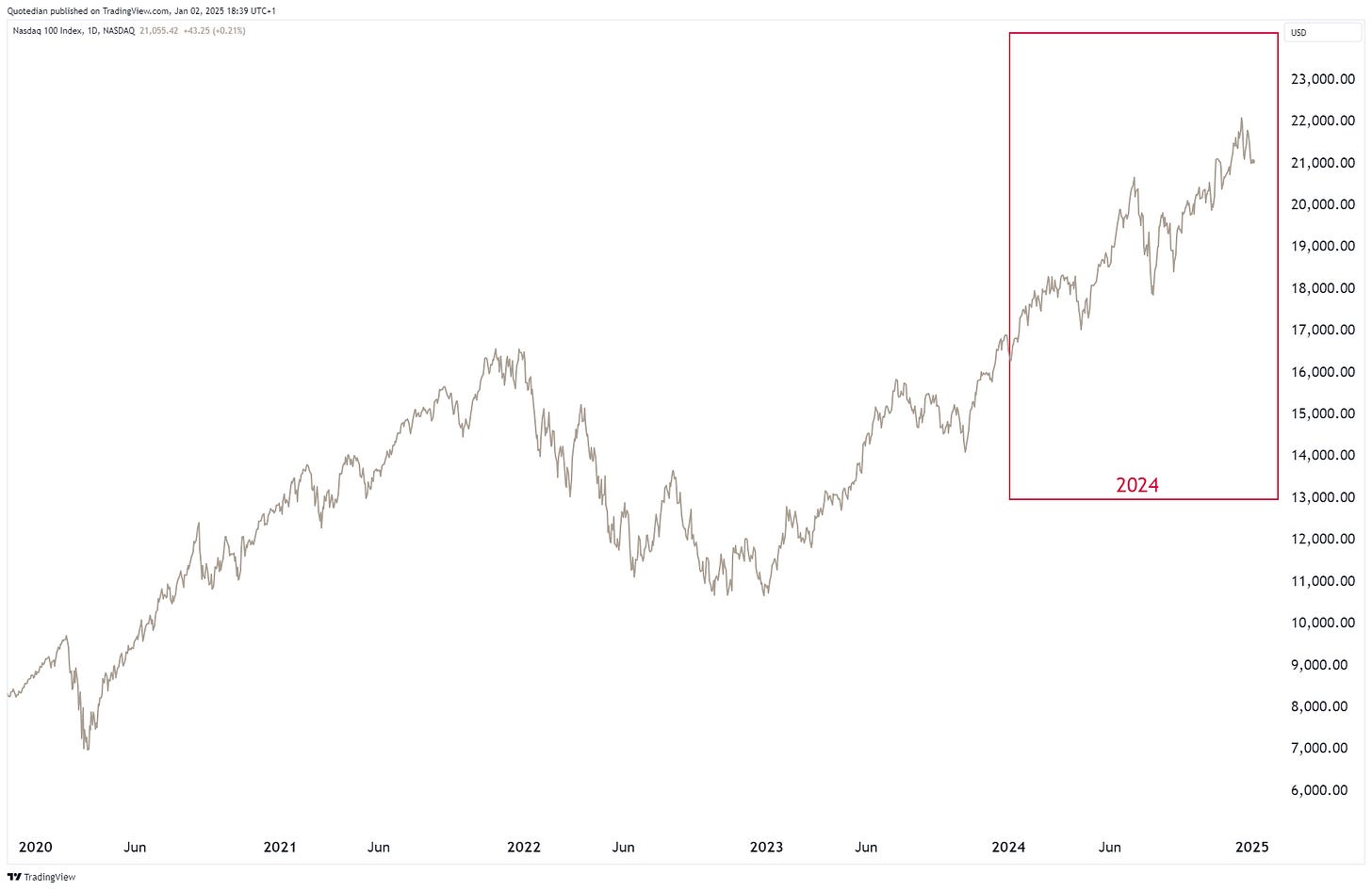

Staying with the Nasdaq a brief moment more, here is what you had expected for that index:

You voted as follows:

And this is the outcome:

40% expected the NDX to rise 25% or more and that is quite precisely what it has done!

One more on US stocks:

WOW! You were pretty split on that one! Here’s the outcome visualized, even though if you read the part above regarding mega-caps, you probably already know the answer. We proxied this question via the S&P 500 (SPX) to Russell 2000 (RTY) yearly performance spread:

Ok, time to check on your guessing prediction regarding European equity performance:

Overwhelmingly you expected European stocks to continue underperformance versus their US peers:

And of course, unless you spend 2024 under a rock, you already know the outcome:

Another similar question was in Mambo Poll #5:

A good two thirds of you expected the value factor to continue to underperform the growth factor:

And the outcome is ……. drumroll…. another drumroll……. a final drumroll:

Yes, at a global level, value underperformed yet again, to the tune of about 15%!

Before we get to the final question of 2023 for your 2024 outlook in the equity section, let’s look at another couple of things first.

For example, equity sector performance in 2024, at a global level:

Keep in mind, that some most of the mega-cap stocks are present in the top performing sectors, slightly skewing the result. But even so, the spread between best and worst-performing sectors is once again astonishing and emphasizes how much effort should be put into sector selection.

Looking at regional sector performances, we would expect a similar performance ranking for US sectors, as most mega-caps are US-domiciled companies:

Indeed!

In Europe, including EU Zone stocks plus Swiss, UK & Swedish stocks, Financials took the lead, whilst Energy, probably not surprisingly, is taking the bottom position:

Ok, we already noticed that large beat small and growth beat value, but let’s have a closer look at Factor performance in 2024, using US indices (simply better data):

So, (price) momentum was once again the big massive winner in 2024, despite some important “momentum crashes” during the year. Here’s the iShares MSCI USA Momentum Factor ETF (MTUM) for illustration purposes:

But, if you wanted to keep it nice and easy, without figuring out which Momentum approach you should use, holding US large cap growth stocks did the trick well for you:

Let’s use this as a segue into our popular tables of the best performing stocks in 2024, which we have been dutifully updating and following each month.

Let’s start with the US list of the 25 top performing stocks in the S&P 500 last year (excluding stocks which started listing during the year, e.g. GEV):

As you may have already guessed, the stocks highlighted in yellow, also made the top 25 list in 2023. In other words, nearly one fourth of the top performers in 2023 repeated in 2024.

Now over to the European list of top 25 performers in the STOXX 600 Europe (SXXP) index:

Coincidence, or not, here also six stocks from 2023 repeated their presence in 2024.

With all this out of the way, let’s address the last question from last year’s polls in the equity section before heading over to the interest rates market:

When asking which of the above indices would perform best in 2023, you had, and please excuse my Spanish, the “cojones” to reply China!

Well, as they say, be careful what you wish for! If comparing only your top two choices (China & US) via popular USD-based ETFs (FXI & SPY) this is the outcome:

Yes, of course there is a small cheat to this, as in our question last year we asked for specific indices, but still …

Here’s the outcome according to that list of indices in local currency terms:

And here the same, but in USD-terms:

Let’s beginn the fixed income section with a review of the performance of same major sub-segments:

The message here is quite clear: It was a good year for credit risk (and the “worse” the better), but not such a good year for carrying non-actively managed duration risk.

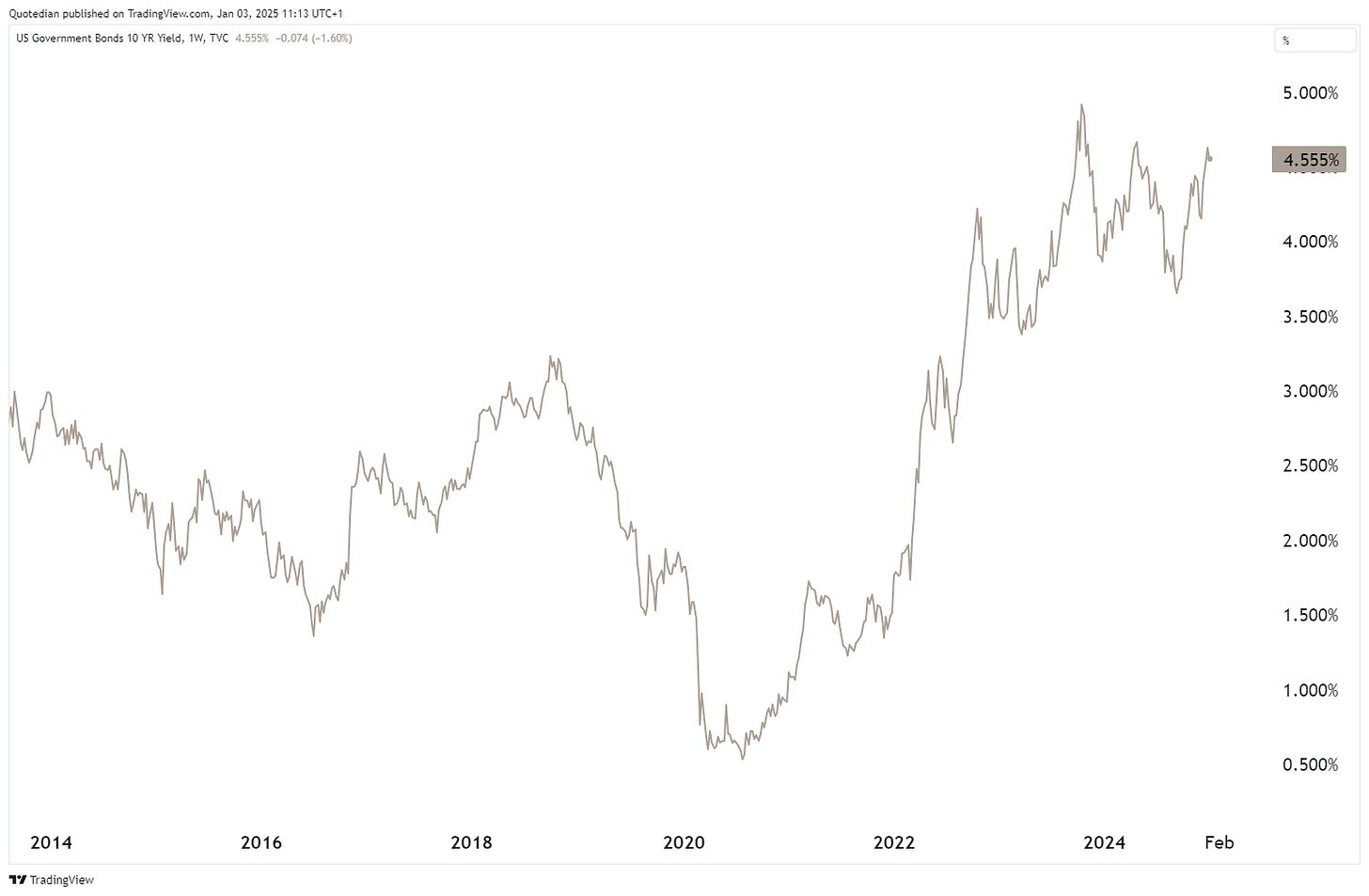

Why do I say “non-managed duration risk”? Because for an active manager, the swings in rates/yields were so wild, there was definitely some value to be extracted, if you are a good market timer got lucky. Here’s the US10-year treasury yield for example:

For many, this “yield thinking” is a bit too abstract, so let me translate the chart above into bond prices %-moves, using the popular iShares 7-10 Year Treasury Bond ETF (IEF), which has a similar duration (7.6) than a US 10-year treasury bond:

The “opportunity” gets yet more impressive when measuring the swings on the even more popular iShares 20+ Year Treasury Bond ETF (TLT), which carries about double the duration (16) of a 10-year treasury bond:

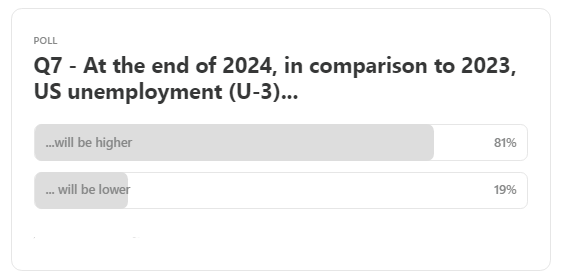

But let’s get back a moment to our 2023 “guestimates” for 2024. This was the first one in the fixed income/macro section:

Most of you thought that unemployment would rise:

Which is of course what happened, yet maybe not to the extent some would have expected:

The second, econmic-related question, was regarding (US) consumer inflation and whether you would think it is higher or lower than it is today:

WOW, another split right down the middle! This was the your vote illustrated on the US CPI chart:

And inflation did indeed fall, not only in the US but in most developed and my emerging markets too. Here’s the same chart as above, updated through to November (December numbers are out on January 15th):

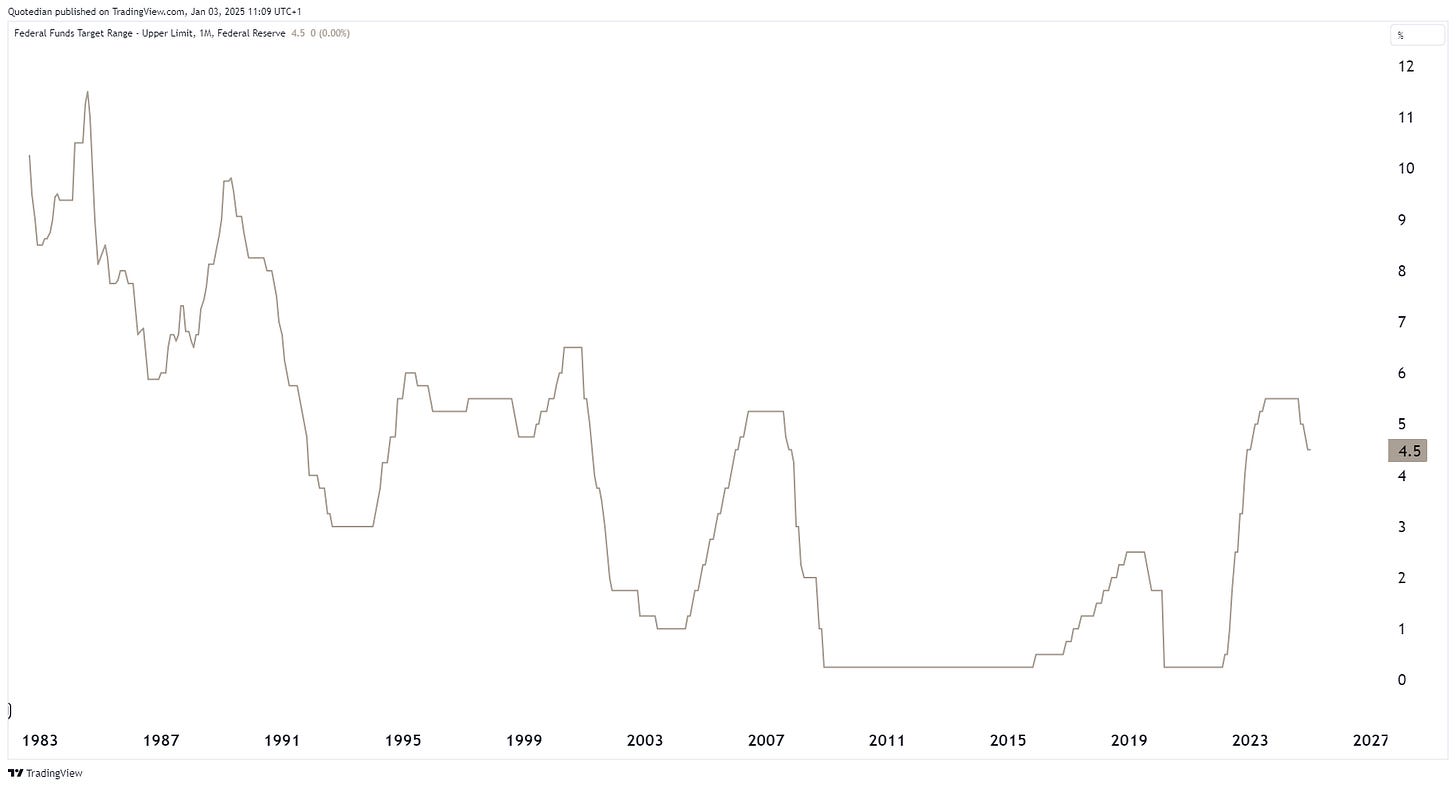

Those previous two questions went of course well hand-in-hand with the next one:

I showed you at the time that the Fed was expecting to cut six times (one cut is 25 bp) by the end of the year 2024, which would have brought rates to 4%, inline with your guessed range:

The Fed cut “only” on four occasions, bringing the upper bound of the Federal Funds Target rate to 4.5%, still bang on inline with your 4-5% projection - BRAVO!

The follow-on question was then regarding US longer-term (10Y) yields, and your expectation for EOY 2024:

This is the outcome:

Again, a large part of you have guessed the right range, though my intuition tells me that you were probably expecting rates to be at the lower end of that 4-5% range, not in the upper half …

The last question in the rates section then was regarding European bond yields:

HA! GOTCHA!

Unlucky though, because only at the beginning of December, the majority of you would have been right! But all kidding aside, this example shows two things: 1) how undecisive you wear regarding European yields and b) how volatile a year it has also been for yields on the old continent …

Hoping happily over into the currency section, I have some awful news for non-Dollar based investors who decided to hedge their USD-asset class exposure (S&P500??):

All major developed currencies underperformed the Greenback last year, especially in Q4 (not shown separately). Most of them substantially so…

Let’s look at a few examples, the first one being the EUR/USD cross, where we also had a poll running:

Well, that’s what I call an even split! Here is the outcome, with the “lower” callers taking all the credit:

We also asked a non-dollar question:

Well, well, well… surprise, surprise! The Euro actually closed up about a percentage point versus the Swiss Franc, probably as the central bank of the latter currency was even more aggressive in cutting rates than the ECB:

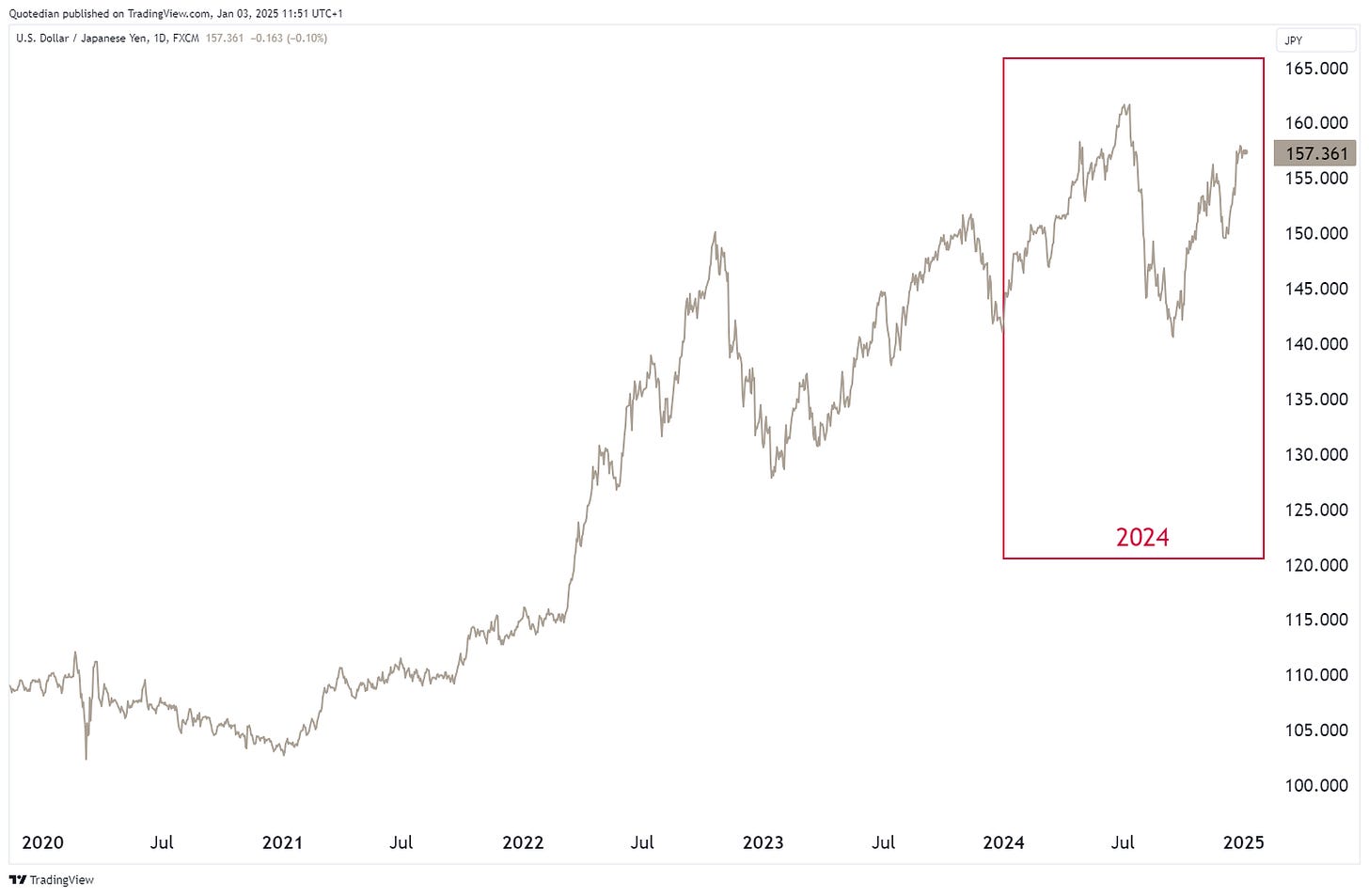

Our third FX question was concerning the USD/JPY (Japanese Yen). Here, the question was a bit more granular, keeping you from making wishy-washy guesses:

Hhmmmmm…

As if on accord, you still managed to come up with a wishy-washy answer amongst all of you !

But, in many ways the wide distribution of your answers is very reflective of the confusing situation going, which then also manifested itself in the USD/JPY cross rate throughout the year:

For completeness purposes, let’s also check on the performances of some emerging market currencies versus the US Dollar in 2024:

Very much the same picture as for developed currency, with the mighty USD beating just about anything.

For the Mexican Peso, be it due the countries own new government or the election of Tarriff-Trump or even a partial unwinding of the carry trade or all of the above, the reversal has been absolutely massive:

And the other currency deeply troubled recently is the Brazilian Real:

Watch this (BRL) space, as the country’s finances seem to be falling apart, not only expressed via the currency (see above), but also via local bond yields (see below):

As you will notice, we did not ask any cryptocurrency related questions at the end of 2023, which may be a (contrarian) indication of how relevant the topic was then.

Definitely, something has changed after the year just gone by:

Bitcoin is of course the posterchild for the “asset class”:

This chart may explain at least partially that interest in BTC was not too high yet after 75% 2022 pullback.

And so we slide into the final section of today’s letter, let’s start with the ‘final’ questions from last year “Superforecasters” letter:

And the commodity ‘sector’ winner was …….

Softs - which was your least likely choice to lead the pack. But probably quite understandably so, as it is a commodity group most of do not follow closely, let alone invest (directly) into it. Precious metals was indeed a good call, however, Energy was pretty disappointing, as it was your second favourite call for 2024.

Let’s take a somewhat more granular look at commodity performances, via some popular futures:

Coffee was definitely the place to be last year, not only for Starbucks lovers, but especially for investors, with futures prices hitting all-time highs (data since the early 1970ies):

However, if the past is any guide to the future (hint: it usually is), then we should buckle up for some major mean reversion:

One of the other good places to be was Natural Gas, but of course, there everything was about mean reversal from very depressed levels:

But, of course, where most of us are (hopefully) really invested is in precious metals, mainly in Gold. And that was another joy year for Gold bugs:

That’s all folks!

The next issue, likely not out until Monday 13th January, called “Happy New Year (ex-ante)” is going to be chart-heavier, as we try to get a glimpse into the year ahead of us.

Maybe one more poll before we leave:

As I have an incredible forecasting capability, I can already foresee the outcome of the vote above,

I may launch a separate letter over the coming days, just focusing on this Pollster questions. Or, I include them in the next schedule letter (13/1) as mentioned above.

Have a great weekend!

André

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance